Subscribe Now - Standard: only $199 per year or Premium: only $299 per year - Click Here

|

|

Login:

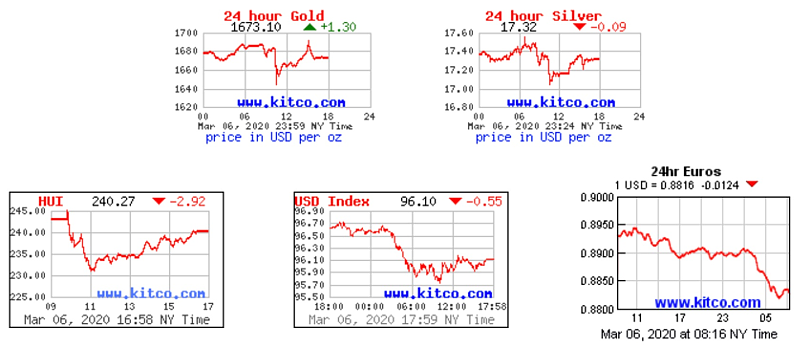

Friday Recap - 6th March 2020I think we are all in a bit of shock by the gyrations of the market this week. The volatility has been historic because of the Coronavirus. No one has a clue what comes next or how far the markets will fall. The miners are still not getting a bid. My portfolio is still down 12% from the recent high two weeks ago. So, even with gold at $1673, it feels like we are losing. A big reason for that is the terrible performance of silver, with the GSR currently at 96.7. Without silver, sentiment in the miners is still awful.

It does appear that gold has a shot at $1700 next week. Plus, the Coronavirus is clearly spreading and has not peaked. That means the markets will have a hard time trending higher the rest of the month. I would expect 24,000 on the DOW to be tested. That's an important level. If we go sub 24,000 expect a possible crash to 20,000. It could get ugly. I think silver wants to see proof of a recession before it wakes up. We might see a 100 GSR. But at some point soon, I expect silver to break out. It could be $1700, $1750, or $1800. One of those levels will be the trigger. It's nice to see the dollar getting weaker. We should see sub 96 next week. That sets up a move to $1700.  |

Follow us on: